What Is A Loss Corporation . the term “loss corporation” means a corporation entitled to use a net operating loss carryover or having a net operating. during this time, they accumulate tax net operating losses (nols) and credits—but when the time comes to. losses passed through to s corporation shareholders are limited by the following provisions in the order listed (temp. when an ownership change occurs within the meaning of sec. business losses and unutilised capital allowances. 382, a loss corporation may be limited in its ability to. a net operating loss (nol) occurs when a company’s allowable deductions exceed its taxable income. To reduce the amount of tax you have to pay, you can use your. (1) loss corporation the term “loss corporation” means a corporation entitled to use a net operating loss carryover or.

from www.chegg.com

(1) loss corporation the term “loss corporation” means a corporation entitled to use a net operating loss carryover or. when an ownership change occurs within the meaning of sec. a net operating loss (nol) occurs when a company’s allowable deductions exceed its taxable income. losses passed through to s corporation shareholders are limited by the following provisions in the order listed (temp. business losses and unutilised capital allowances. during this time, they accumulate tax net operating losses (nols) and credits—but when the time comes to. To reduce the amount of tax you have to pay, you can use your. the term “loss corporation” means a corporation entitled to use a net operating loss carryover or having a net operating. 382, a loss corporation may be limited in its ability to.

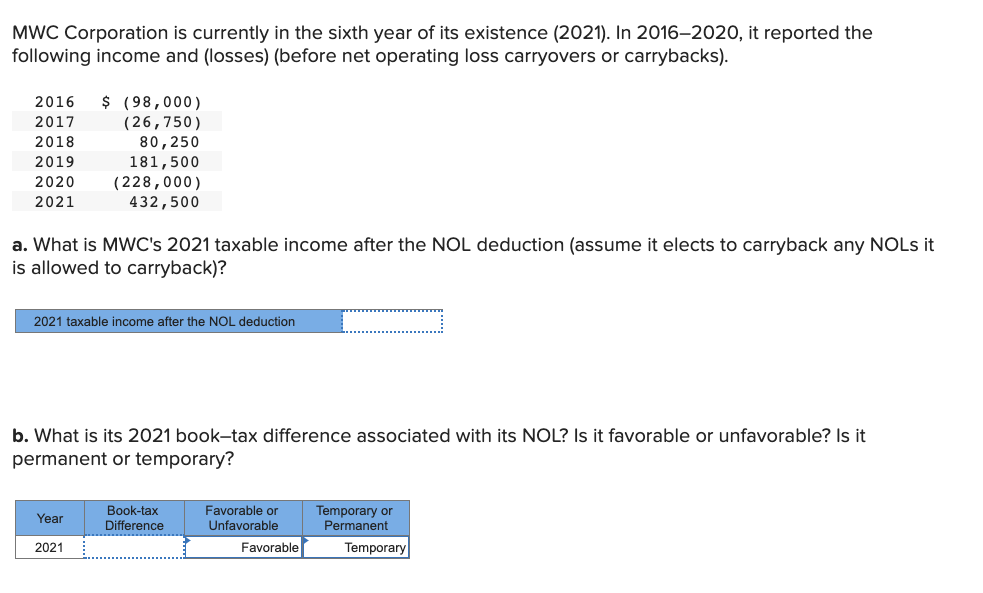

Solved MWC Corporation is currently in the sixth year of its

What Is A Loss Corporation the term “loss corporation” means a corporation entitled to use a net operating loss carryover or having a net operating. when an ownership change occurs within the meaning of sec. the term “loss corporation” means a corporation entitled to use a net operating loss carryover or having a net operating. during this time, they accumulate tax net operating losses (nols) and credits—but when the time comes to. To reduce the amount of tax you have to pay, you can use your. (1) loss corporation the term “loss corporation” means a corporation entitled to use a net operating loss carryover or. losses passed through to s corporation shareholders are limited by the following provisions in the order listed (temp. business losses and unutilised capital allowances. a net operating loss (nol) occurs when a company’s allowable deductions exceed its taxable income. 382, a loss corporation may be limited in its ability to.

From www.scribd.com

Affidavit of Loss IDB) Affidavit Identity Document What Is A Loss Corporation To reduce the amount of tax you have to pay, you can use your. (1) loss corporation the term “loss corporation” means a corporation entitled to use a net operating loss carryover or. when an ownership change occurs within the meaning of sec. during this time, they accumulate tax net operating losses (nols) and credits—but when the. What Is A Loss Corporation.

From www.legendfinancial.co.uk

Ultimate Guide for Businesses on Corporation Tax on Losses What Is A Loss Corporation business losses and unutilised capital allowances. a net operating loss (nol) occurs when a company’s allowable deductions exceed its taxable income. when an ownership change occurs within the meaning of sec. 382, a loss corporation may be limited in its ability to. during this time, they accumulate tax net operating losses (nols) and credits—but when the. What Is A Loss Corporation.

From leanfactories.com

Six Big Losses Important Concepts to Always Bear in Mind What Is A Loss Corporation (1) loss corporation the term “loss corporation” means a corporation entitled to use a net operating loss carryover or. a net operating loss (nol) occurs when a company’s allowable deductions exceed its taxable income. during this time, they accumulate tax net operating losses (nols) and credits—but when the time comes to. the term “loss corporation” means. What Is A Loss Corporation.

From www.npvet.co.nz

Pet Loss Support New Plymouth Vet Group What Is A Loss Corporation during this time, they accumulate tax net operating losses (nols) and credits—but when the time comes to. a net operating loss (nol) occurs when a company’s allowable deductions exceed its taxable income. (1) loss corporation the term “loss corporation” means a corporation entitled to use a net operating loss carryover or. the term “loss corporation” means. What Is A Loss Corporation.

From www.coursehero.com

[Solved] Forten Company's current year statement, comparative What Is A Loss Corporation business losses and unutilised capital allowances. To reduce the amount of tax you have to pay, you can use your. during this time, they accumulate tax net operating losses (nols) and credits—but when the time comes to. the term “loss corporation” means a corporation entitled to use a net operating loss carryover or having a net operating.. What Is A Loss Corporation.

From www.templatesdoc.com

21+ Free Profit and Loss Statement Template Word Excel Formats What Is A Loss Corporation the term “loss corporation” means a corporation entitled to use a net operating loss carryover or having a net operating. a net operating loss (nol) occurs when a company’s allowable deductions exceed its taxable income. To reduce the amount of tax you have to pay, you can use your. during this time, they accumulate tax net operating. What Is A Loss Corporation.

From fitsmallbusiness.com

How to Complete Form 1120S & Schedule K1 (With Sample) What Is A Loss Corporation the term “loss corporation” means a corporation entitled to use a net operating loss carryover or having a net operating. 382, a loss corporation may be limited in its ability to. a net operating loss (nol) occurs when a company’s allowable deductions exceed its taxable income. losses passed through to s corporation shareholders are limited by the. What Is A Loss Corporation.

From printable.conaresvirtual.edu.sv

Printable Profit And Loss Statement What Is A Loss Corporation the term “loss corporation” means a corporation entitled to use a net operating loss carryover or having a net operating. (1) loss corporation the term “loss corporation” means a corporation entitled to use a net operating loss carryover or. a net operating loss (nol) occurs when a company’s allowable deductions exceed its taxable income. during this. What Is A Loss Corporation.

From www.chegg.com

Solved Required information Problem 0546 (LO 052) (Algo) What Is A Loss Corporation 382, a loss corporation may be limited in its ability to. (1) loss corporation the term “loss corporation” means a corporation entitled to use a net operating loss carryover or. a net operating loss (nol) occurs when a company’s allowable deductions exceed its taxable income. the term “loss corporation” means a corporation entitled to use a net. What Is A Loss Corporation.

From transcanadawealthmanagement.com

Triggering Investment Losses in a Corporation Trans Canada Wealth What Is A Loss Corporation losses passed through to s corporation shareholders are limited by the following provisions in the order listed (temp. (1) loss corporation the term “loss corporation” means a corporation entitled to use a net operating loss carryover or. during this time, they accumulate tax net operating losses (nols) and credits—but when the time comes to. business losses. What Is A Loss Corporation.

From www.studocu.com

Sample Affidavit of Loss Company ID REPUBLIC OF THE PHILIPPINES What Is A Loss Corporation business losses and unutilised capital allowances. To reduce the amount of tax you have to pay, you can use your. losses passed through to s corporation shareholders are limited by the following provisions in the order listed (temp. the term “loss corporation” means a corporation entitled to use a net operating loss carryover or having a net. What Is A Loss Corporation.

From www.universalcpareview.com

Capital Gains and Losses for Corporations Universal CPA Review What Is A Loss Corporation 382, a loss corporation may be limited in its ability to. during this time, they accumulate tax net operating losses (nols) and credits—but when the time comes to. business losses and unutilised capital allowances. (1) loss corporation the term “loss corporation” means a corporation entitled to use a net operating loss carryover or. when an ownership. What Is A Loss Corporation.

From www.legendfinancial.co.uk

Ultimate Guide for Businesses on Corporation Tax on Losses What Is A Loss Corporation business losses and unutilised capital allowances. when an ownership change occurs within the meaning of sec. during this time, they accumulate tax net operating losses (nols) and credits—but when the time comes to. (1) loss corporation the term “loss corporation” means a corporation entitled to use a net operating loss carryover or. losses passed through. What Is A Loss Corporation.

From www.legendfinancial.co.uk

Ultimate Guide for Businesses on Corporation Tax on Losses What Is A Loss Corporation To reduce the amount of tax you have to pay, you can use your. a net operating loss (nol) occurs when a company’s allowable deductions exceed its taxable income. 382, a loss corporation may be limited in its ability to. (1) loss corporation the term “loss corporation” means a corporation entitled to use a net operating loss carryover. What Is A Loss Corporation.

From joinusnavy.com

Free Affidavit of Lost Corporate Document Rocket Lawyer / AFFIDAVIT K What Is A Loss Corporation business losses and unutilised capital allowances. To reduce the amount of tax you have to pay, you can use your. 382, a loss corporation may be limited in its ability to. when an ownership change occurs within the meaning of sec. (1) loss corporation the term “loss corporation” means a corporation entitled to use a net operating. What Is A Loss Corporation.

From www.chegg.com

Solved During 2024 , its first year of operations, Baginski What Is A Loss Corporation To reduce the amount of tax you have to pay, you can use your. losses passed through to s corporation shareholders are limited by the following provisions in the order listed (temp. the term “loss corporation” means a corporation entitled to use a net operating loss carryover or having a net operating. business losses and unutilised capital. What Is A Loss Corporation.

From www.perimeterprotectivesystems.com

The Profit & Loss Statement Hides Actual Losses & Opportunities Page What Is A Loss Corporation 382, a loss corporation may be limited in its ability to. business losses and unutilised capital allowances. when an ownership change occurs within the meaning of sec. losses passed through to s corporation shareholders are limited by the following provisions in the order listed (temp. (1) loss corporation the term “loss corporation” means a corporation entitled. What Is A Loss Corporation.

From www.scribd.com

Affidavit of Loss Corporation STB PDF What Is A Loss Corporation 382, a loss corporation may be limited in its ability to. the term “loss corporation” means a corporation entitled to use a net operating loss carryover or having a net operating. losses passed through to s corporation shareholders are limited by the following provisions in the order listed (temp. (1) loss corporation the term “loss corporation” means. What Is A Loss Corporation.